Term to 100 life insurance is a game-changer for securing your future. It’s like having a safety net, especially for those planning to cover their needs for the next century. This policy offers a way to protect your loved ones financially if the unexpected happens, giving you peace of mind knowing you’re covered.

Understanding the specifics of this type of insurance is crucial. It’s about making informed decisions about coverage amounts, premiums, and the overall benefits. We’ll delve into everything, from the basics to the nuances, so you can confidently choose the right policy for your situation.

Understanding the Term “Term to 100 Life Insurance”

Term to 100 life insurance, a type of temporary life insurance, provides coverage for a specified period, typically until the age of 100. This coverage is designed to offer protection during a crucial phase of life, offering financial security for dependents in the event of an untimely death. It is a valuable tool for individuals seeking a defined period of coverage for specific financial goals.

Definition and Key Features

Term to 100 life insurance is a temporary life insurance policy that offers coverage for a predetermined period, often extending to age 100. A key feature is its affordability compared to permanent life insurance options. Premiums are generally lower because the insurer’s risk is limited to the policy’s term. The policy’s benefits are typically tied to the insured’s death within the coverage period.

It’s designed to provide financial protection for a defined period, often until a certain age. This approach is particularly useful for individuals with specific financial goals or responsibilities during that timeframe.

Coverage Amounts and Benefits

Coverage amounts for term to 100 policies can vary significantly based on factors like the insured’s health, lifestyle, and desired protection level. The benefits are typically a lump-sum payment to beneficiaries in the event of the insured’s death during the policy term. Policyholders should carefully consider the coverage amount needed to meet their financial obligations, such as mortgages, outstanding debts, and dependents’ support.

A thorough assessment of financial needs and risk tolerance is essential for selecting an appropriate coverage amount.

Yo, so, term to 100 life insurance is kinda crucial, right? But like, first things first, wanna know if Maria’s Pizza is open today? Check it out is Maria’s pizza open today before you dive into the insurance stuff. Seriously though, getting that term to 100 life insurance sorted is totally important for your future, you know?

Policy Length

The typical length of coverage for a term to 100 policy is, as the name suggests, until the age of 100. However, policy terms can be adjusted to align with specific financial needs. Some policies might offer flexibility in extending the coverage period, which is important for adapting to life’s changing circumstances. Understanding the flexibility offered by various insurers is crucial for future-proofing financial plans.

Comparison with Other Life Insurance Types

Term to 100 life insurance differs significantly from permanent life insurance, which provides lifelong coverage. Permanent policies typically have higher premiums but offer cash value accumulation, a feature absent in term insurance. Term insurance focuses on providing coverage for a defined period, while permanent insurance aims for lifelong protection. The choice depends on individual financial goals and risk tolerance.

The key comparison lies in the length of coverage and the presence of cash value.

Advantages and Disadvantages

One significant advantage of term to 100 life insurance is its affordability, as premiums are typically lower than for permanent life insurance. This makes it accessible to a wider range of individuals. A disadvantage is the lack of cash value accumulation, which is a key feature of permanent life insurance products. Another disadvantage is that the coverage ends at the policy’s maturity date.

Therefore, individuals should carefully weigh the pros and cons to make an informed decision.

Policy Features and Benefits

Term to 100 life insurance policies offer a specific type of coverage, designed to protect individuals until they reach the age of 100. Understanding the features and benefits is crucial for making an informed decision. These policies often come with unique premium structures and rider options, impacting the overall cost and benefits.The core benefit is a guaranteed death benefit, which is payable upon the policyholder’s death during the coverage period.

Certain policies might also include the potential for a cash value component, which can be accessed or withdrawn under specific circumstances. However, this is not always a feature of all “term to 100” policies. The availability and specifics of these features and benefits are crucial factors to evaluate when choosing such a policy.

Premium Structures

Premiums for term to 100 life insurance are typically calculated based on several factors, including the policyholder’s age, health status, and desired coverage amount. Higher coverage amounts and younger ages usually lead to higher premiums. These premiums are often fixed for the policy term, though some policies might offer premium adjustments based on specified conditions. The policyholder should carefully review the premium structure and its potential long-term implications.

Rider Options

Many term to 100 policies offer riders that enhance the basic coverage. These riders can include accidental death benefits, critical illness riders, or accelerated death benefits. These riders usually come with additional premiums. The choice of riders depends on the individual’s specific needs and risk tolerance.

Exclusions and Limitations

Every insurance policy has exclusions and limitations. It is essential to understand these exclusions to ensure the policy covers the risks relevant to the policyholder. For example, certain pre-existing conditions or specific activities may be excluded from coverage. A thorough review of the policy’s exclusions and limitations is critical.

Yo, lookin’ for a term to 100 life insurance plan? It’s all about securing your future, right? Thinking about a new crib? Check out some sweet homes for sale in La Vergne, TN, at homes for sale la vergne tn. Nah, but seriously, a term to 100 policy is a solid choice if you’re tryna lock in coverage for a longer time.

You know, for peace of mind. Solid deal!

Death Benefits

The primary benefit of term to 100 life insurance is the death benefit. This benefit is paid out to beneficiaries upon the policyholder’s death within the policy term. The amount of the death benefit is typically a predetermined amount stated in the policy document. This amount is essential for covering potential financial obligations left behind.

Potential Cash Value

Some “term to 100” policies might offer a cash value component. This feature allows policyholders to access funds from the policy’s accumulated value under certain circumstances. However, this feature is not universal and depends on the specific policy. Policyholders should carefully review the terms and conditions surrounding cash value components.

Appropriate Scenarios

This type of insurance is most appropriate for individuals seeking long-term life insurance coverage until the age of 100. It’s often a suitable option for those who desire a substantial death benefit without the complexities of permanent life insurance. Consider individuals who want a fixed premium for a considerable period.

Key Features Comparison

| Feature | Policy A | Policy B | Policy C |

|---|---|---|---|

| Premium Cost (Annual) | $1,500 | $2,000 | $2,500 |

| Coverage Amount | $500,000 | $750,000 | $1,000,000 |

| Policy Duration | 100 years | 100 years | 100 years |

Note: Premium costs and coverage amounts are illustrative examples. Actual costs and coverage will vary based on individual circumstances.

Impact of Age on Benefits

The benefits of term to 100 life insurance can vary depending on the policyholder’s age. Younger individuals typically qualify for lower premiums, while older individuals might face higher premiums. The death benefit remains consistent regardless of age at the time of policy purchase. A comprehensive understanding of the impact of age on premium costs is crucial.

Eligibility and Application Process: Term To 100 Life Insurance

Obtaining term to 100 life insurance involves a structured application process that assesses the applicant’s eligibility. Understanding the criteria and steps involved is crucial for a smooth application and successful policy acquisition. This section details the typical eligibility requirements, the application process, the role of medical underwriting, and potential reasons for denial.The eligibility criteria for term to 100 life insurance typically consider the applicant’s health, age, and lifestyle.

Factors such as pre-existing medical conditions, family history of certain illnesses, and current health status are often evaluated. The insurance company aims to assess the risk associated with insuring the applicant for a substantial period (up to 100 years of age), which directly impacts the premium rates and overall policy terms.

Eligibility Criteria

Applicants for term to 100 life insurance policies generally need to meet specific criteria. Age is a primary factor, with insurers often setting minimum and maximum age limits. Health conditions, both current and past, are carefully scrutinized. The insurer will look for evidence of pre-existing conditions, which might affect the premium or even the policy approval. Lifestyle choices, such as smoking habits, alcohol consumption, and participation in high-risk activities, also contribute to the assessment of risk.

Application Process

The application process for term to 100 life insurance involves several steps. Initially, the applicant completes an application form providing personal details, health history, and financial information. Thoroughness and accuracy in completing this form are essential for a smooth application process. Subsequently, the insurer verifies the information provided. Medical underwriting is a critical part of this process.

Medical Underwriting

Medical underwriting plays a significant role in evaluating the applicant’s health and assessing the risk of insuring them. This process involves a review of medical records, including doctor’s reports, hospitalizations, and diagnoses. The insurer may also conduct additional medical examinations to gain a more comprehensive understanding of the applicant’s health. The findings from medical underwriting directly influence the decision on policy approval and the premium amount.

Required Documents

The specific documents required for applying for term to 100 life insurance may vary depending on the insurer. However, some common documents include:

| Document Type | Description |

|---|---|

| Completed Application Form | Accurate and complete details about the applicant’s personal information, health history, and financial information. |

| Proof of Identity | Valid government-issued identification, such as a driver’s license or passport. |

| Proof of Age | Valid document proving the applicant’s age, such as a birth certificate. |

| Medical Records | Previous medical reports, doctor’s notes, hospital discharge summaries, and any other relevant medical documents. |

| Financial Statements | Documents showing the applicant’s financial situation, such as income statements and tax returns. |

Potential Reasons for Application Denial

A term to 100 life insurance application might be denied due to various factors. Applicants with serious health conditions, a history of critical illnesses, or a family history of life-threatening diseases might face denial. Inaccurate or incomplete information provided in the application form could also lead to denial. Failure to submit required documents or meet the insurer’s underwriting criteria can result in an application being rejected.

If the applicant’s lifestyle is deemed too high-risk, the insurer may also decline the application. Insurers are obligated to ensure they are not taking on excessive risk, and these criteria are in place to maintain the stability of the insurance business.

Cost and Premiums

Term life insurance policies, including “term to 100” plans, operate on a premium structure designed to cover the risk of death during a specified period. Understanding how premiums are calculated and the factors influencing their cost is crucial for making informed decisions about these policies.Premiums are not a fixed amount but are dynamically adjusted to reflect the risk associated with insuring a specific individual.

The greater the risk, the higher the premium. This calculation process considers various factors, including the insured’s age, health status, lifestyle, and desired coverage amount.

Premium Calculation Methodology

Premiums for term to 100 policies are calculated using actuarial models. These models project the probability of death within a specific age range, factoring in mortality rates. The premiums are then adjusted based on the individual’s characteristics.

“Actuarial models use statistical data on mortality rates to predict the likelihood of death within a certain timeframe, which is a key component in calculating insurance premiums.”

Factors Influencing Premium Costs

Several factors directly impact the premium amount for a term to 100 policy.

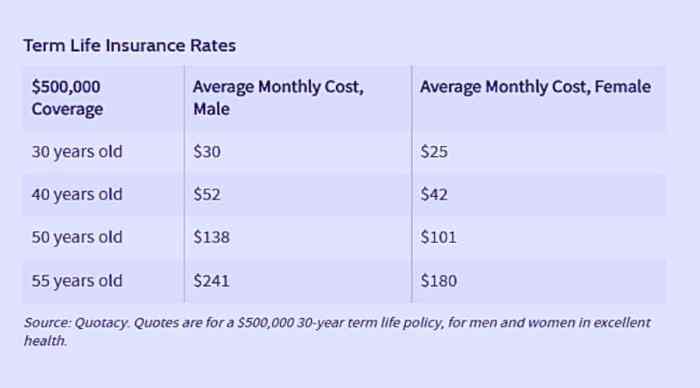

- Age: Mortality rates increase with age. Younger individuals generally have lower premiums due to a lower probability of death compared to older individuals. This age-based differential is a significant determinant in the premium structure.

- Health Status: Individuals with pre-existing health conditions or a history of certain illnesses are generally considered higher risk. Insurance companies may adjust premiums based on medical assessments or require additional medical examinations to evaluate the risk profile.

- Lifestyle: Certain lifestyle choices, such as smoking, excessive alcohol consumption, or participation in high-risk activities, increase the risk of death and may result in higher premiums. These factors are often reflected in the premiums charged.

- Coverage Amount: The higher the desired coverage amount, the higher the premium. This is because a larger coverage amount necessitates a higher premium to compensate for the greater financial protection offered.

Comparative Analysis of Premium Costs

Term to 100 policies often have premiums that are more affordable in the early years compared to permanent life insurance policies. However, the premiums tend to increase significantly as the insured approaches the policy’s maturity date. A comparison with other life insurance options should always include the specific coverage amount and duration to offer an accurate assessment. This comparison should also account for potential future health changes and lifestyle factors that might influence future premiums.

Premium Cost Table (Illustrative)

The following table presents an illustrative comparison of premium costs based on age and coverage amount. Note that these are illustrative examples and actual premiums may vary significantly based on individual circumstances.

| Age | Coverage Amount (Rp) | Estimated Annual Premium (Rp) |

|---|---|---|

| 30 | 100,000,000 | 5,000,000 |

| 30 | 200,000,000 | 7,500,000 |

| 40 | 100,000,000 | 6,000,000 |

| 40 | 200,000,000 | 9,000,000 |

Impact of Premium Payment Options

Different premium payment options can affect the overall cost of a term to 100 policy. For example, paying premiums annually might result in slightly higher costs compared to paying monthly, which can be influenced by the financial institution’s payment structure and other factors. These variations need to be considered during the decision-making process.

Alternatives and Comparisons

Beyond the “term to 100” life insurance option, a range of other life insurance policies cater to diverse financial needs. Understanding these alternatives is crucial for making informed decisions. Each type offers varying coverage, cost structures, and durations, necessitating a careful assessment of personal circumstances.Comparing “term to 100” with other options provides a clearer picture of suitability. Factors like desired coverage, financial resources, and future aspirations play significant roles in selecting the appropriate policy.

This comparison helps individuals evaluate the pros and cons of different policies in relation to their individual circumstances.

Alternative Life Insurance Types

Different types of life insurance policies exist, each with its own set of characteristics. These alternatives provide various levels of coverage and financial protection. Choosing the right type hinges on understanding the unique features of each option.

- Term Life Insurance: This type offers coverage for a specified period (e.g., 10, 20, 30 years). Premiums are typically lower compared to permanent life insurance, making it a more budget-friendly choice for those seeking temporary protection. The coverage terminates at the end of the term, unless renewed.

- Permanent Life Insurance: Unlike term life insurance, permanent policies provide lifelong coverage. Common types include whole life and universal life insurance. These policies often include a cash value component that grows over time, offering investment opportunities and potential tax benefits. Premiums tend to be higher than term life insurance due to the longer coverage period and investment component.

Comparison of “Term to 100” with Other Types

A direct comparison of “term to 100” life insurance with other types reveals distinct characteristics.

| Policy Type | Coverage Duration | Cost (Premiums) | Features |

|---|---|---|---|

| Term to 100 | 100 years (or until age 100) | Generally moderate, potentially higher than shorter-term options but lower than some permanent policies. | Provides long-term coverage, often suitable for individuals seeking comprehensive protection throughout their lifespan. |

| Term Life Insurance (e.g., 20-year term) | 20 years | Typically lower than permanent options. | Suitable for specific needs, like funding a child’s education or covering mortgage payments, with a definite end date. |

| Permanent Life Insurance (e.g., Whole Life) | Lifelong | Higher than term options. | Provides lifelong coverage and a cash value component that grows over time. |

Importance of Individual Financial Needs

A crucial factor in choosing a life insurance policy is aligning it with personal financial needs. A thorough evaluation of income, expenses, and future goals helps determine the appropriate coverage amount and duration. For instance, a young professional with a mortgage might require higher coverage than a retired individual with no outstanding debts. Factors such as dependents, outstanding loans, and retirement planning contribute significantly to the determination of the optimal coverage amount.

The ideal policy balances the need for adequate protection with affordability. Considering individual circumstances and future financial goals are critical for making the right decision.

Customer Service and Claims Process

Term to 100 life insurance policies, like other insurance products, require a robust customer service and claims process to ensure smooth operations and timely resolution of policyholder concerns. Effective communication channels and clear claim procedures are vital for maintaining policyholder trust and upholding the insurance company’s commitment.The customer service and claims process for term to 100 life insurance policies is designed to be straightforward and efficient.

Policyholders can access various channels for assistance, while the claims process is structured to minimize delays and maximize fairness.

Customer Service Channels

The availability of multiple communication channels allows policyholders to connect with the insurance provider in a manner that suits their needs. These channels typically include a dedicated customer service phone line, an online portal with self-service options, and email support. Each channel is designed to handle specific types of inquiries, from routine policy questions to more complex claims situations.

Claim Filing Procedure

Filing a claim involves a series of steps. Policyholders must first determine if the death is covered under the policy. This involves understanding the policy’s terms, particularly the definition of covered events and exclusions. Documentation of the event is crucial. Important documentation includes the death certificate, the policy itself, and any supporting evidence that may be required.

Common Reasons for Claim Denials

Claims can be denied for various reasons. Failure to meet policy requirements, such as providing complete and accurate information, is a common cause. Misrepresentation of facts, either intentionally or unintentionally, can also lead to claim denial. In addition, if the death is due to an excluded cause or if the insured did not meet the policy’s eligibility criteria at the time of death, the claim may be denied.

Policyholders should carefully review their policy’s terms and conditions to understand the circumstances that could lead to a claim denial. Pre-existing conditions and suicide are often excluded.

Claim Process Steps, Term to 100 life insurance

The following table Artikels the key steps in the claims process, along with associated deadlines and required documents. This table provides a clear framework for understanding the claim process.

| Step | Description | Deadlines | Required Documents |

|---|---|---|---|

| Notification of Claim | Policyholder notifies the insurance company about the death. | Within a specific timeframe (e.g., 30 days) after the death | Policy document, death certificate |

| Claim Assessment | The insurance company reviews the claim to determine if it aligns with policy terms. | Within a specified period (e.g., 30 to 60 days) | All relevant documentation (e.g., medical records, police reports) |

| Decision on Claim | The insurance company makes a decision on the claim (approval or denial). | Within a predetermined timeframe (e.g., 60 to 90 days) | Same as above, possibly additional documentation |

| Payment of Claim (if approved) | The insurance company pays the benefits to the beneficiaries as per the policy terms. | Within a specified period (e.g., 30 days after the decision) | Beneficiary information, proof of relationship |

Claim Scenarios

Different scenarios can illustrate the claim process. For example, a death due to a natural cause, with complete documentation, should be a relatively straightforward claim process. Conversely, a death due to an accident with missing documentation could lead to a delayed or denied claim. A death caused by a pre-existing condition, even if the policyholder was insured, might result in a claim denial.

Illustrative Examples and Scenarios

Term to 100 life insurance offers a unique solution for long-term financial protection. Understanding how it can benefit different individuals and families is crucial for making informed decisions. This section provides illustrative examples to better visualize the practical applications of this insurance type.

A Hypothetical Customer Benefitting from Term to 100

A 35-year-old, Sarah, is a dedicated professional with a young family. She plans to support her children’s education and ensure their future well-being. Term to 100 life insurance provides her with substantial coverage for the next 65 years, allowing her to fulfill these financial goals. Sarah’s financial needs are substantial, and the coverage provided by a term to 100 policy addresses this need while aligning with her long-term financial goals.

Protecting a Family’s Financial Future

Imagine a scenario where a breadwinner, aged 40, dies unexpectedly. Term to 100 life insurance, with a substantial death benefit, can cover outstanding mortgages, children’s education expenses, and provide a financial cushion for the surviving family. This coverage ensures that the family’s financial stability isn’t jeopardized by the unexpected. The policy’s long-term nature addresses the evolving financial needs of a family over a considerable period.

Benefits for Retirement Planning

Term to 100 life insurance can play a crucial role in retirement planning. An individual approaching retirement can use this policy to cover potential healthcare costs, long-term care expenses, or other unexpected financial obligations. The long-term coverage helps secure the individual’s financial future during retirement.

Comparison with Other Long-Term Coverage Options

A 50-year-old, David, is considering various long-term life insurance options. Term to 100 life insurance offers competitive premiums compared to whole life or universal life insurance, particularly for individuals seeking long-term coverage without the complexities of cash value accumulation. He should carefully compare coverage amounts, premiums, and policy features across different types of life insurance to find the best fit for his specific financial needs and risk tolerance.

A comparison table would highlight the differences in premium structures and the level of coverage offered.

| Feature | Term to 100 | Whole Life | Universal Life |

|---|---|---|---|

| Premium Structure | Level premiums for a specified period | Level premiums or increasing premiums | Flexible premiums, often based on investment performance |

| Coverage Period | Typically up to age 100 | Lifetime | Lifetime |

| Cash Value | No cash value accumulation | Cash value accumulation | Cash value accumulation |

Policy Lapse and Coverage Impact

A policy lapse occurs when a policyholder fails to make required premium payments. This results in the termination of coverage. If Sarah, for example, were to experience financial hardship and lapse her term to 100 policy, the death benefit would no longer be available. This underscores the importance of consistent premium payments to maintain coverage. The policyholder should ensure that they understand the policy’s terms and conditions to avoid any issues.

Ultimate Conclusion

In short, term to 100 life insurance is a powerful tool for financial security. By understanding the features, costs, and alternatives, you can make a smart choice that aligns with your individual needs and goals. It’s about protecting your future and the future of those you care about. Remember to weigh the pros and cons carefully before making a decision.

Questions and Answers

Q: What are the typical eligibility criteria for term to 100 life insurance?

A: Generally, you need to be in good health, and your age will be a significant factor. Insurance companies use medical underwriting to assess your risk, which is based on your health status.

Q: How are premiums for term to 100 policies calculated?

A: Premiums are calculated based on several factors, including your age, health, lifestyle, and the amount of coverage you want. Companies use complex algorithms and actuarial tables to determine the appropriate premium for your profile.

Q: What are some common reasons for claim denials?

A: Misrepresentation of health information during the application process, or if you engage in high-risk activities after policy issuance, could result in a claim denial. It’s crucial to be honest and upfront about your health and lifestyle choices.

Q: What are some alternatives to term to 100 life insurance?

A: Other options include permanent life insurance, which provides lifelong coverage. Term life insurance offers coverage for a specific term, while whole life insurance combines aspects of both. Choosing the right option depends on your specific needs and financial situation.